- China sees explosion in EV production and increased exports fivefold

- The global spare parts market grew by 6.8% in 2022

- VW was the largest vehicle manufacturer by market value in 2022, at €279232m

The Global Automotive Logistics 2023 Report from Ti Insight shows market instability, major supply chain shifts and offers insight on vehicle manufacturer activity.

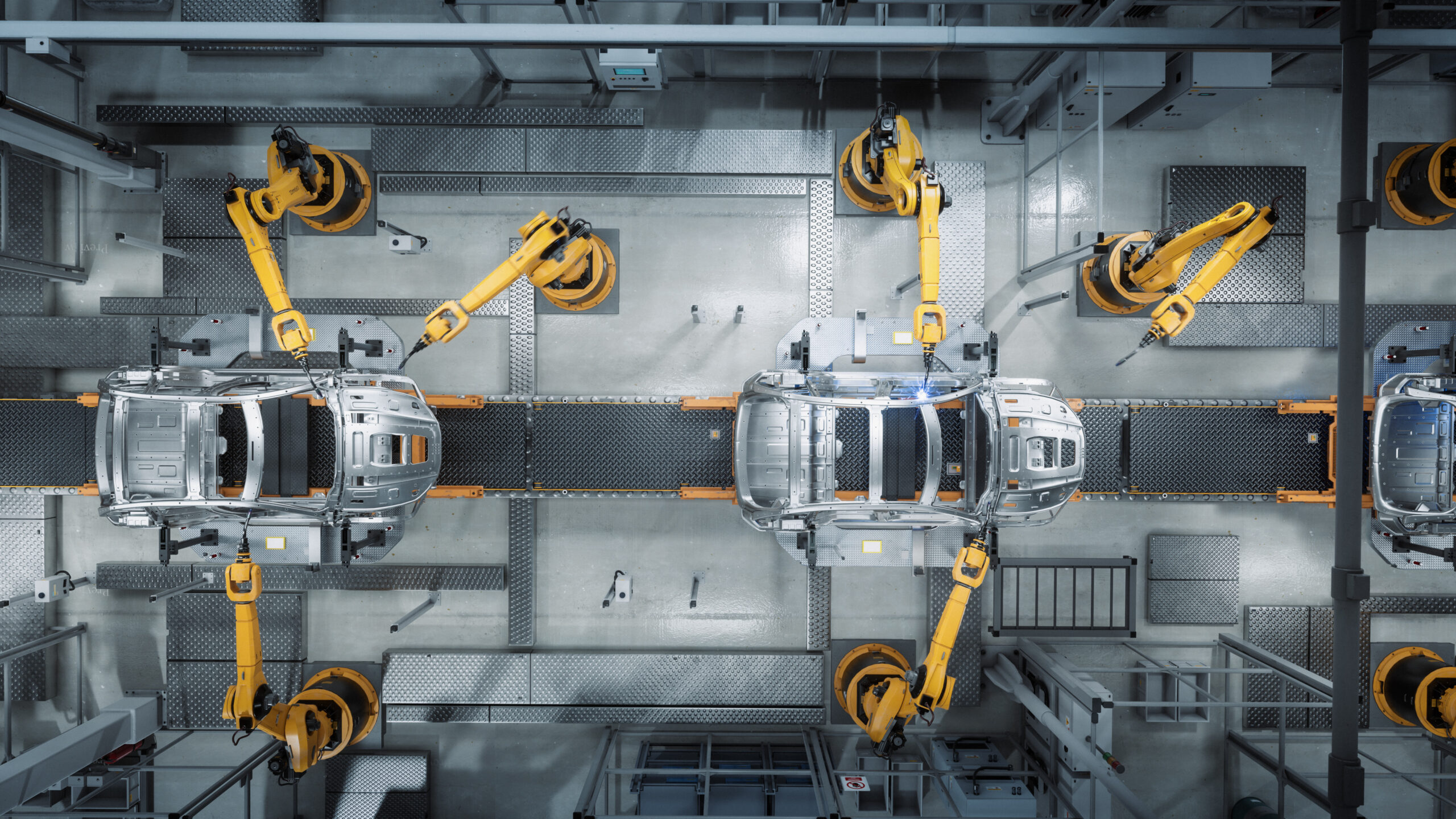

A lack of coordination between vehicle manufacturers and semi-conductor manufacturers is causing a major shift in the balance of power between the supplier and the supplied. That’s according to the Global Automotive Logistics 2023 Report from Ti Insight, a 40-page document which includes automotive trends, analysis, market sizing, forecasts, manufacturer case studies and an overview of selected automotive logistics service providers.

“The past five years have been a period of remarkable instability in the automotive sector Worldwide,“ explains Senior Editor Julia Swales. “The impact of the supply chain crisis of 2020-2022 was extreme, with large falls in production volumes of a magnitude that have not been seen for at least the past decade. The implications for the logistics sectors serving the automotive sector have been severe.”

The Global Automotive Logistics 2023 Report from Ti Insight – the leading provider of market research to the global logistics industry – shows that the violent shift in technology is already visible and supply chain geographies are rapidly changing as manufacturers attempt to locate semiconductor production approximate to assembly plants.

Report Highlights:

- By the end of 2023, the global automotive logistics market is forecast to grow by 3.1%.

- The global automotive 2022-2027 CAGR is forecast to be 4.2%.

- The global spare parts market grew 6.8% in 2022 and is expected to grow another 2.3% in 2023.

- Inventory will be managed in a very different manner, with a move away from traditional concepts such as ‘just-in-time’.

- China has seen an explosion in EV production and has increased exports fivefold, changing the nature of international trade in passenger vehicles.

- The shift to new propulsion systems is the dominant development in the automotive sector alongside the emergence of digital guidance systems.

- Given the nascent and evolving nature of battery supply chains, vehicle manufacturers are adopting different approaches to their development.

- Battery supply chains are changing rapidly and ‘legacy’ vehicle manufacturers are investing in dedicated battery production.

- The violent shift in technology is already visible and supply chain geographies are rapidly changing as manufacturers attempt to locate semiconductor production approximate to assembly plants.

- The balance of power has changed between semi-conductor manufacturers and vehicle manufacturers without the vehicle manufacturers sufficiently understanding the consequences.

- BMW is deploying trucks powered by CO2-neutral, second-generation biofuels and testing and implementing hydro-treated vegetable oil (HVO) with its logistics partners.

The report – written by industry researchers, analysts and associates ̶ is one of several reports published each month by the Ti team, utilising data from its GSCI knowledge portal, a data powerhouse with over 1million pieces of data and analysis.

Author: Ti Insight

Source: Ti Insights